Introduction

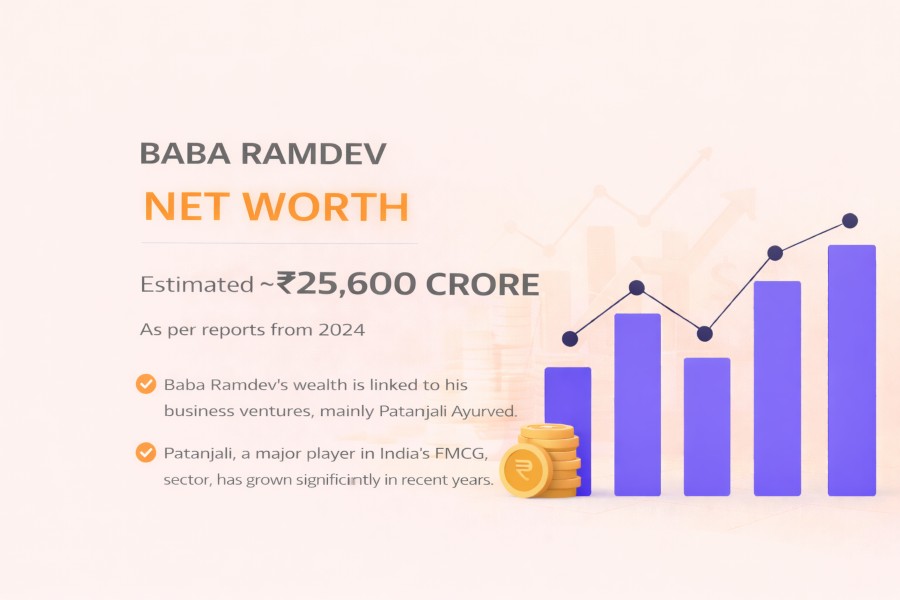

Baba Ramdev is a household name in India, transitioning from a humble yoga teacher to the face of a multi-billion dollar FMCG empire. As the co-founder of Patanjali Ayurved, he has disrupted the Indian consumer market, challenging global giants with a "Swadeshi" (indigenous) narrative. This leads to a fascinating debate: What is Baba Ramdev's net worth? How can a saffron-clad sanyasi (monk) who claims to own no shares be at the helm of one of India's most valuable private conglomerates?

While his business partner, Acharya Balkrishna, holds the majority of the equity, Baba Ramdev is the brand's ultimate engine. His personal lifestyle remains austere—living in an ashram and practicing rigorous yoga—yet he commands an economic ecosystem that includes listed companies, vast agricultural lands, and a global supply chain. This analysis explores the financial mechanics of the Patanjali empire, the valuation of its core assets, and the paradox of a "Billionaire Monk" who owns nothing but controls everything.

The Patanjali Empire: From Ashram to Stock Market

Patanjali Ayurved & Market Disruption

Patanjali Ayurved Limited is the cornerstone of Ramdev's financial influence. Starting as a small pharmacy in Haridwar, it evolved into a consumer goods behemoth. By leveraging Ramdev's massive television following, the brand saved billions in traditional marketing costs. Today, Patanjali produces everything from honey and ghee to noodles and personal care products.

The company’s valuation has fluctuated over the years, but at its peak, it was estimated to be worth over ₹30,000 Crore. While growth has stabilized, the organization's reach into rural India remains unparalleled. This massive revenue stream is the fuel for the "Ramdev Economy," allowing for rapid expansion into sectors like textiles (Patanjali Paridhan) and dairy.

The Strategic Acquisition of Patanjali Foods (Ruchi Soya)

A pivotal moment in the financial evolution of Baba Ramdev was the acquisition of Ruchi Soya Industries through an insolvency process. Now renamed Patanjali Foods Ltd, this is a publicly listed entity with a multi-billion dollar market capitalization. This move shifted the group from a private, opaque structure to a transparent, stock-market-driven valuation.

As of late 2024/2025, Patanjali Foods boasts a market cap frequently exceeding ₹50,000 Crore. While Baba Ramdev himself does not hold a majority of the shares, his influence over the board and the brand’s strategic direction makes him the de facto architect of this public wealth.

-

Patanjali Foods Ltd Listed Powerhouse

The crown jewel of the group's public assets. With a dominant position in the edible oil market and a growing FMCG portfolio, this listed entity provides the group with immense borrowing power and institutional credibility. It represents the "hard" financial value of the Ramdev brand on Dalal Street.

-

Patanjali Wellness & Yog Gram Healthcare Assets

Beyond retail, the group owns vast medical retreats like Yog Gram and Niramayam. These facilities provide Naturopathy and Ayurvedic treatments to thousands of high-paying guests. These are high-margin assets that combine real estate value with recurring service revenue, often overlooked in pure FMCG valuations.

-

Supply Chain & Land Bank Infrastructural Wealth

The Patanjali Food & Herbal Park in Haridwar is one of the largest of its kind globally. The foundation owns or controls thousands of acres of land across India for medicinal plant cultivation and manufacturing units. This land bank, concentrated in Uttarakhand and surrounding states, constitutes a massive hidden asset base.

The Ownership Mystery: Acharya Balkrishna's Role

The 94% Stakeholder

Technically, Baba Ramdev's personal net worth is near zero because he holds no equity in Patanjali Ayurved. His childhood friend and associate, Acharya Balkrishna, holds approximately 94% of the shares. This structure has catapulted Balkrishna into the Forbes list of India's richest individuals, with a personal wealth often estimated between $3 Billion and $5 Billion.

However, the public perceives this as "Ramdev's wealth." Ramdev serves as the "Brand Ambassador" and spiritual guide. This unique arrangement allows Ramdev to maintain his status as a renunciate while directing the activities of a commercial giant. It is a masterclass in separating personal ownership from institutional control.

Political and Social Capital

Wealth isn't just about cash; it's about influence. Baba Ramdev's net worth is amplified by his "Social Capital." His ability to mobilize millions of followers, his proximity to top political leadership, and his influence over national policy regarding Ayurveda are invaluable. This "Soft Power" has allowed the organization to secure land, favorable regulations, and a loyal customer base that views purchasing Patanjali as a patriotic act.

Controversies and Financial Resilience

Regulatory Battles and Misleading Ads

The road to billions hasn't been smooth. Patanjali has frequently clashed with the Advertising Standards Council of India (ASCI) and the Supreme Court over "misleading" advertisements. From claims about curing COVID-19 with 'Coronil' to disparaging allopathy, these controversies have led to legal fines and reputational risks. Despite these hurdles, the brand's financial resilience is notable, as its core consumer base remains steadfast.

Quality Control & Competition

As the company scaled, quality control became a challenge. Various products have faced temporary bans or failed laboratory tests. Furthermore, traditional giants like HUL and ITC have launched their own "Ayurvedic" lines to counter Patanjali. The financial future of the group depends on its ability to transition from a "personality-led" brand to a "quality-led" corporate entity.

Comparative Analysis: The Guru Economy

| Leader | Core Model | Personal Ownership | Primary Market |

|---|---|---|---|

| Baba Ramdev | FMCG & Retail | None (Balkrishna owns) | Consumer Goods / Retail |

| Sadhguru | Spiritual Tourism | None (Trust based) | Education & Wellness |

| Sri Sri Ravi Shankar | Global Education | None (Trust based) | Wellness & Ayurveda |

| Mata Amritanandamayi | Charity & Education | None (Trust based) | Healthcare & Universities |

Conclusion: The Monk Who Sold the World Swadeshi

In the final tally, Baba Ramdev's net worth is a philosophical question as much as a financial one. On paper, he is a man of no means. In reality, he sits at the apex of a ₹50,000 Crore empire. He has successfully commodified ancient Indian traditions into a modern, high-speed retail engine.

His legacy is the creation of a "Third Way"—a model that is neither purely capitalistic nor purely charitable. By using commerce to fund his vision of a "Yoga-filled India," he has built a self-sustaining cycle of wealth that is likely to outlast his individual presence. Whether he is a monk or a tycoon is irrelevant to the market; the market simply knows that Baba Ramdev is one of the most powerful economic forces in 21st-century India.

Frequently Asked Questions

Baba Ramdev claims to have zero personal net worth. He does not hold shares in Patanjali Ayurved or its subsidiaries. However, he controls the organization that manages assets worth billions of dollars. His lifestyle is funded by the Patanjali trust.

Acharya Balkrishna is the majority owner, holding roughly 94% of the shares in Patanjali Ayurved Ltd. This ownership makes him one of the richest men in India, according to the Forbes Billionaires List.

The combined turnover of the Patanjali Group (including Patanjali Foods and Patanjali Ayurved) is estimated to be between ₹30,000 Crore and ₹45,000 Crore annually, making it one of the largest FMCG players in India.

Patanjali Ayurved and its listed entities are subject to corporate taxes like any other business. As an individual, since Ramdev does not draw a salary or own shares, his personal tax liability is different from that of a corporate CEO, though the trust and companies pay their required dues.

Final Financial Overview

Baba Ramdev has redefined the role of a spiritual leader in the 21st century. By merging the saffron robe with the boardroom, he has created an economic fortress. His "net worth" is best measured by the millions of households that use his products daily and the thousands of jobs his factories provide. He remains the ultimate "Billionaire of Influence."